365 days, $10 Million, 3 Rounds, 2 Companies, all with 5 Magic Slides

By True Ventures, November 2, 2010

Since moving to San Francisco a little over a year ago, I have spent every day helping to build Socialcast and about.me. During this time, I have raised more than $10 million combined over 3 funding rounds for both Socialcast and about.me. Convincing venture capitalists to invest in two startups in less than 365 days was a challenging task, but one that quickly taught me the dos and don’ts of raising money. Here is an overview of the unique lessons I learned during the fundraising process, mostly focused on the initial meeting, which is the most crucial as you are introducing your company and vision for the first time.

Stop using the projector for initial meetings

Most of my initial venture partner meetings ended up in a conference room. To project my slides I would normally bring an Apple Mini DisplayPort to VGA adaptor. While at the office of a well-known large fund, I realized that I had left my adaptor in another bag. Instead of looking unprepared and asking to borrow an adaptor, I decided to adjust my plan and use my laptop screen to walk through the slides. I wouldn’t recommend this if you’re meeting with more than 2 people, but this meeting was one of my best and resulted in a term sheet. Why did this work? Normally, in a pitch meeting, you and the investor sit on opposite sides of the conference table. But by sharing a screen and sitting in close proximity to each other, the environment naturally becomes more comfortable and relaxed.

Understanding an investor’s perspective

Every venture partner has his or her own ideal approach to learning about your business. Some are ‘product guys’ who will want to really dig in to your product or service. Other are financed focused, while others will be initially focused on the team you have assembled. Knowing what type of founder you are is critical to finding the right investment partner. Do you want to work with someone who has the same focus as yourself? Or would you rather work with an investor who brings a different yet complementary focus to the company? You should always know the background of every investor you meet with and attempt to determine what their focus is before meeting them. You can do this by looking at their prior work experience – did they run a sales organization or a product group? Or have they been in venture their entire career? Their prior experiences can give you a fairly confident idea of their perspective and expertise on company-building.

The initial slide deck

Usually, an initial meeting lasts 30 minutes to 1 hour. The time moves fairly quickly and I have sat in on pitches where the investor is left no time to answer questions. This is typically due to the founder bringing an excess of slides, most of which at this point are unnecessary. The initial meeting exists so that you can introduce your company to the potential investor, gauge interest, and move to the next step in the process. In order to achieve this desired outcome, you must give a solid overview of the business without falling into a discussion or technical rathole. Ratholes typically happen due to an excess of slides that slow the progression and flow of the meeting. During my fund raising, I took an extreme approach to initial meetings where I only utilized 5 slides. The worst thing you could do is open up a presentation that says page 1 of 30. If you can’t outline your business in just 5 slides, you should go back to the drawing board and simplify your messaging. After initial introductions and chit chat at the onset of the meeting, I would then typically begin my presentation with something like the following:

“I have a short five-slide deck to share that provides a solid framework for understanding our business.”

Opening with this simple statement frames your presentation in the mind of the investor. They now know upfront that there are only 5 slides as opposed to 30. When I began with this statement, I instantly noticed increased engagement on the part of the potential investors. Note that below are only the slides as I spoke directly about much of the vision, strategy, value, and potential of the business.

The Magic 5 Slide Framework

I created the following slides directly from my actual pitch decks just swapping out confidential details and people.AcmePower is a fictitious company.

Slide 0: Cover slide with company logo and date

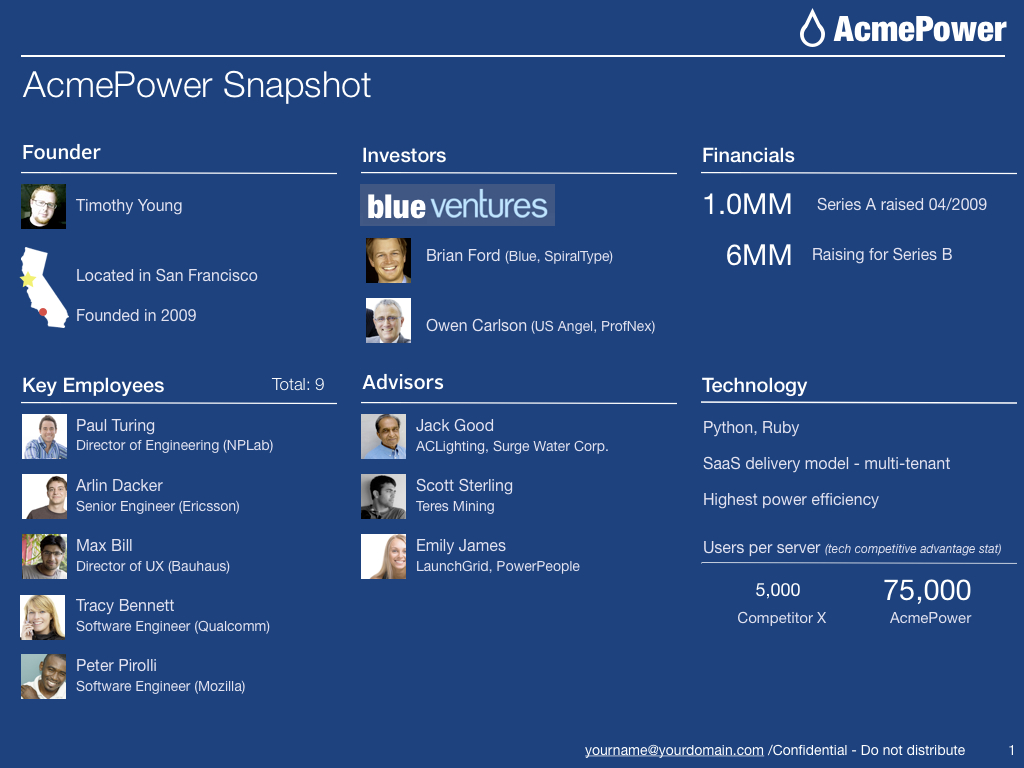

Slide 1: Company Snapshot

Containing a quick view of the people currently involved including: Founders, Investors (Angels, Friends and family, etc.), Key Employees & Advisors, Financials (Money raised if any & amount of funding desired), Technology (What are you using? – does not need to be specific), and Customers (banner clients, # of active users, etc.)

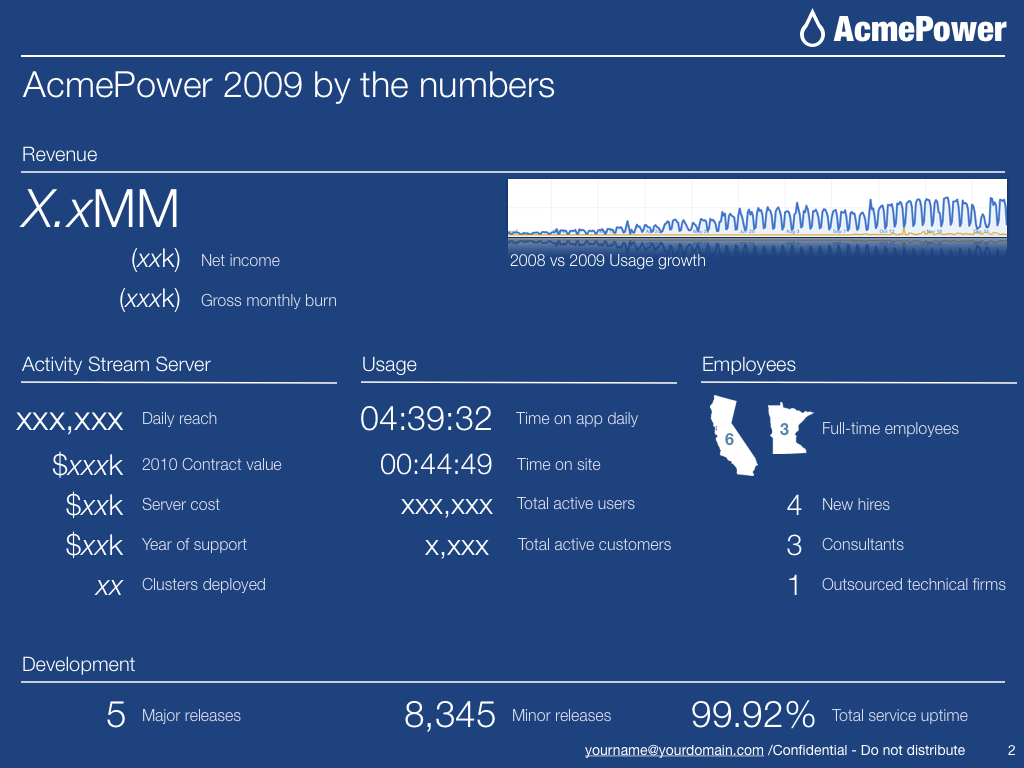

Slide 2: The Numbers

Containing the numerical story of the company so far including revenue if any (also net income, current monthly burn).

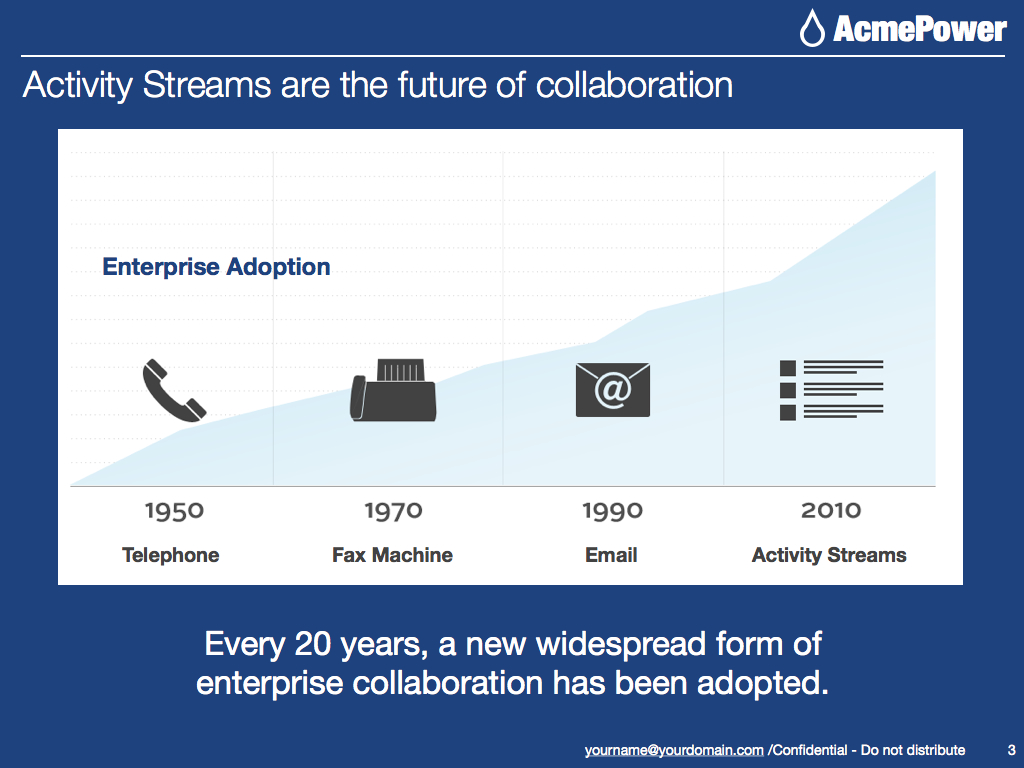

Slide 3: The Timeline (aka The Money Slide)

Humans love patterns. It is how we interpret the world. It takes time and research to put this slide together but it has turned out to be the most valuable. I have known 5 other startups in the past 6 months who have used this slide type and all have been successful in raising capital. I view this as the most important slide in the entire deck. Here you are setting up the trend pattern and then move right into the demo. This creates a powerful narrative where you tell them you know the future and then move right into showing them the future with your demo. Note: Below I used the actual slide from my Socialcast deck covering the rise of activity streams.

Blank Slide: Product Demo

Whether pitching to a single partner or to the entire partnership of a firm, there were times where I wanted to make a point but someone always wanted to go back and discuss the current or previous slide. After this happened twice, I adapted my presentation to incorporate blank slides. I would literally insert blank slides in my deck where I wanted to make a strong verbal point or transition. The blank slide immediately brought everyone’s attention back to me. I would use blank slides sparsely as you do not want to overdo it (they’re used for dramatic effect). In my initial meeting five slide deck, I used a blank slide to transition to a short product demo in the middle of the presentation.

Slide 4: Traction / Customer Overview

Slide 5: Where we are going

First you want to list the top 3 priorities the company is currently focusing on and also make sure to include how you think investors can help. These are all talking points for your pitch.

Supporting Slides

With this 5 slide deck I also had with me approximately 40 supporting slides. I rarely had to use these slides during the initial meeting but they were used in subsequent meetings. These slides were in a separate presentation that I only went into if part of the discussion required deeper background. I would talk about all of these aspects of the business during my pitch and I could quickly bring them up during the discussion to share if needed. The roughly 40 slides were broken into the following sections:

* In depth background of each team member

* A couple existing customer case studies outlining value proposition

* A couple slides on customer acquisition strategy

* Deep technology overview

* Target customer profiles

* Market size opportunity

Rules for Slides

I always follow a few simple yet critical rules for slides:

1. Faces, faces, faces. It’s all about the faces (a little ode to Dave McClure). In your slide deck, remember to use the faces of your employees. Do not just list a bunch of employee names. Remember that investors are investing primarily in a team of people. Make sure to feature them and reinforce it.

2. Keep it simple and the less text the better. I try not to have more than one point or key message per slide. Anything more and you will see people picking up their Blackberry.

3. Make sure your slide deck communicates a story. Sure, the product and team are great, but you want to share the journey and offer the investors a ride.

4. Never read your slides. The potential investor is trying to understand who you are and how well you can sell your vision. Reading from your slides removes all passion from the presentation.

5. Slides should have supporting data only. Remember what you say is what counts the most; not just what is on your slides.

and most importantly:

6. Slides can’t look into peoples’ eyes. You can. Your eyes help sell your vision, passion, enthusiasm, and most importantly, the journey you want to share with the potential investor.

Hopefully these lessons will help you in raising capital and clearly communicating your vision. You can download the slides in PDF format here: Magic 5 Slide Deck PDF

This post was written by Tim Young, Founder of Socialcast, a True Ventures Portfolio Company.